The CRTC’s Latest Communications Monitoring Report Provides a Window on a Future That Is Getting Clearer and Clearer

In its 2018 Communications Monitoring Report, the full version of which was released last February, the Canadian Radio-television and Telecommunications Commission (CRTC), among other data and extensive analyses, provides an answer to the question asked in a recent post on CMF Trends: Is linear TV really dead?

Not yet, insists the CRTC: “Even though Internet-based services are becoming more popular, a great majority of Canadians continue to use traditional TV and radio services. More specifically, in 2017, on average 94% of Canadians watched traditional television and 88% listened to radio in any given month. These penetration figures are far higher than those for their Internet-based counterparts, which stood at 63% for Internet television and 59% for streaming music content on YouTube.”

Given that the legislative framework of both sectors that are the focus of the CRTC’s report, i.e., broadcasting and telecommunications, is currently under joint review, considering the ties that exist between them, this statement speaks volumes.

Traditional services have remained relatively popular, but their environment has evolved over the course of the past decades with the arrival of a parallel system that escaped regulation and hindered its stability and predictability. In this entry, we take a look at the indicators provided in the CRTC’s report that enable us to establish the main elements making up this transformation and gain insight into the future.

Linear TV remains popular but for how much longer?

In 2017, Canadians aged 18+ tuned in on average to 27 hours of content per week among the approximately 800 television services authorized for distribution in Canada. In addition to turning to traditional television, these Canadians watched 3.4 hours of Internet television on average per week, for a total of 30.4 hours of content viewing per week.

For comparative purposes, in 2009, Canadian adults watched an average of 28.8 hours of television per week and half an hour of television on the Internet—but mostly on amateur video sites (Netflix was not yet available in Canada)* . The actual total is therefore close to 29.5 hours per week.

At first glance, Canadians today consume more television content, whether it be through traditional means or online. Although watching television online has contributed to a slow decrease of the number of hours spent watching traditional television, IPTV has yet to have led to a significant decrease in the time spent watching linear television. That is consistent with the large quantity of high-quality content that is now available.

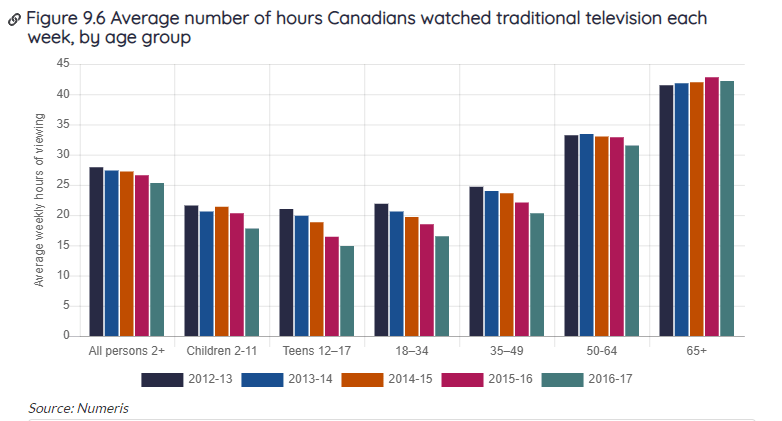

However, although the weekly hours spent viewing traditional television decreased modestly (by an average of 2.4% per year among Canadians aged two and up) from 2012 to 2017, the numbers show a more pronounced decrease among young viewers. For example, among teens, the average decrease was 8.1% per year.

Viewers who were teens ten years ago have not returned to traditional television either, contrary to what some people had predicted would happen once they began in life and started a family. Among 18–34 year-olds, the average decrease was 7%. Members of this age group watched an average of 20.6 hours of traditional television in 2009; today, they only watch 16.5 hours.

IPTV is slowly but surely gaining ground

The most meaningful data presented in the CRTC’s report are probably those provided in the section titled “Internet-based video services in Canada”:

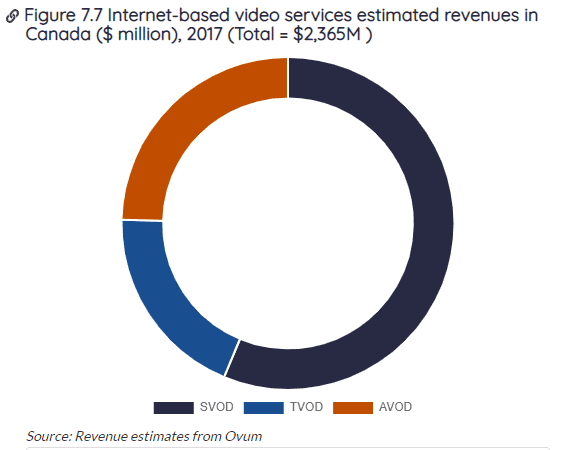

Internet-based video services are a growing segment. This market segment generated revenues totalling an estimated $2.4 billion in Canada in 2017. Considering that the traditional television sector generated $6.9 billion in revenues in 2017, Internet-based video services would represent approximately 35% of this total, comparable to the revenues of private and CBC conventional television stations combined.

Whereas, a few years ago, these services were referred to as “over-the-top services” (in the sense of ‘passing over’ the regulated system), the CRTC today considers them as forming a segment of the broadcasting market. It’s an evolution that is representative of the place that these services occupy in the system today.

This market is growing, contrary to the regulated market: the television sector generated total revenues of $6.9 billion in 2017, down by 5% compared to 2016.

In the Internet-based video services market, on-demand services (SVOD) reap the lion’s share of revenue and are registering the strongest growth.

As is the case of the traditional broadcasting system, only a few services generate most of the revenues of Internet-based video services. In 2017, the three leading services—Netflix, iTunes and YouTube—generated revenues estimated at $1.3 billion, which represents 55% of all Internet-based video service revenues.

With revenues totalling $860 million, Netflix is not surprisingly the most lucrative subscription-based service in Canada. Indeed, the company has a 36% share of the Internet-based video service market.

In July of last year, we posted a summary of the report produced by The Convergence Research Group on online television. According to this analysis, there were 25 online television services available in Canada, with 75% of them being of foreign origin with a strong majority based in the US.

There is no denying that foreign online television services are gaining ground in Canada’s communication system. From 2013 to 2017, the estimated revenues generated by online services grew by an average of 38.8% per year. Moreover, the revenues that they generate from their presence in this market, essentially through foreign programming, surpass those of traditional television in Canada, which slowly declined from 2013 to 2017 due mainly to the decrease in revenue generated from the sale of traditional television advertising.

Apple's offensive

Apple recently announced the launch of its Apple TV Plus service without, however, providing too much detail. The service will be available in more than 100 countries starting this coming fall, but no launch date or subscription cost has yet to have been announced. Observers estimate that Apple will be spending some US$2 billion this year to acquire original content that will be distributed on this platform.

In addition to investing in the production of original content, Apple announced that the Apple TV app will become the core of its direct-to-consumer video subscription offer along with another novelty, Apple TV Channels. The latter will propose a new television experience providing consumers with the possibility of paying only for the channels they want to watch. Apple has already reached agreements with HBO, Showtime, Starz, CBS All Access and other on-demand services. Pursuant to these agreements, all transactions with these channels will be done directly through Apple’s app.

In the post titled Linear TV: Not Dead Yet, we concluded by asking ourselves if consumers, faced with a growing offer of specialized direct-to-consumer services such as those proposed by Apple as well as those announced by Disney and AT&T, will not end up subscribing to them as a substitute for the cable and/or online television services they may already be subscribing to. In any case, it’s what Apple seems to be betting on.

* Sources: Communications Monitoring Report, 2010 and 2013 editions